Near-Term Uranium Production: Where are the Re-Starts Coming From?

- HoldCo Markets

- Mar 22, 2024

- 4 min read

DISCLAIMER: Any written content contained herein should be viewed strictly as analysis & opinion and not in any way as investment advice. No compensation was received for this report. Visitors to this site are encouraged to conduct their own due diligence.

Though we expect total uranium supply to grow by a mere ~1% from FY/2023 to FY/2024, we are forecasting healthy mine supply growth in that same timeframe, with global production expected to increase by +10%, largely due to projects coming on-stream in North America (mostly from Cameco's continuous ramp-up of McArthur River), and selectively in Africa. Sulfuric acid issues aside, we expect the next leg of growth will likely come in 2026 when Kazatomprom (KAP) really ramps up with Inkai No.3. Though production from Kazakhstan is expected to increase in the next 2-3 years, we've ramped down expectations due to the inability to source the required sulfuric acid needed to maintain production levels as grades decline. We expect that Kazatomprom has already depleted most of the easy to mine/high grade resource and will now need increasing amounts of acid to keep the level of production steady, let alone to have it increase. It's been estimated that Kazatomprom will require ~2.0M tpa of sulfuric acid to meet current targets. Note as well that new development projects will require more acid due to the requirements for initial acidification (as is the case with Budenovskoye 6 and 7).

All said, we forecast total mine supply to be ~154M lbs in FY/2024, with global demand amounting to ~180M lbs. Though secondary supplies still more than make up for the deficit, note that the 48M lbs from last year will likely decline to ~35M lbs in FY/2024. We further forecast secondary supplies to contribute within the low 20M lbs from 2027 and continue lower in the subsequent years after.

For the time being, we examine the near term mine supply expected to come on-stream within the next 24 months. This involves a look at the various near-term re-start projects, all of which happen to be domiciled in North America or Africa. Excluding the on-going ramp at McArthur River, we highlight the projects below as the easiest or most feasible to re-start (if not already publicly committed to):

Though Cameco (CCO, CCJ) has already publicly committed to ramping up McArthur River, recall that this past fall, the Canadian Nuclear Safety (CNSC) renewed the licenses for Key Lake and McArthur River (valid until 31 October 2043) and the license for Rabbit Lake (valid until 31 October 2038). Cameco's FY/2024 production guidance is for 18.0M lbs (100% basis) at each of McArthur River/Key Lake and Cigar Lake. This alone bumps Canada's annual uranium production output by ~21% y/y. Like McArthur River, production from Rabbit Lake was suspended in January 2018 due to "persistent weakness in the global uranium market".

At Kayelekera in Malawi, Lotus Resources (LOT) announced earlier this year its plans to re-start the mothballed mine. Though the mine has been on care & maintenance since 2014, uranium production is expected to re-start by sometime in late 2025 (a re-start decision is expected in ~12 months following signed off-take agreements).

In the US, the re-start options comprise the ISR projects of Alta Mesa (enCore Energy (EU)), Lance (Peninsula Energy (PENMF)) and Christensen Ranch & Burke Hollow (Uranium Energy Corp (UEC)). Out of these projects, Alta Mesa should be the first to re-start production, an announcement is eagerly anticipated in the weeks ahead. At Lance, management has guided towards fully in-housed production commencing towards the end of 2024. Annually, both Alta Mesa and Lance will be 1.0M lb+ producing assets, with Lance specifically having the potential to become considerably larger. Concerning Christensen Ranch, though no re-start timetable was provided, Uranium Energy Corp. did submit an application to the Wyoming Department of Environmental Quality to expand the Irigaray CPP from a licensed capacity of 2.5M lbs to 4.0M lbs per year. Wellfield and satellite preparations were previously completed last year.

Concerning the (largely) conventional production side, IsoEnergy (ISO) plans to re-start conventional mining (via toll milling from Energy Fuels' White Mesa Mill) at its Tony M mine, located in Utah. A comprehensive work program is required (planned for by the end of 1H/2024) to re-open the mine which was in production from 1979-1984 and from 2007-2008. A comprehensive work program to reopen the decline and assess the underground conditions is necessary before a technical/economic study can be prepared to validate the re-start plans. Energy Fuels (UUUU, EFR) announced in February that it will prepare the Whirlwind and Nichols Ranch (ISR) mines for production within 12 months.

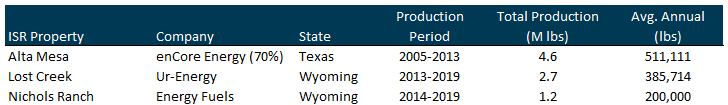

At the current moment we don't expect much from either either Whirlwind or Nichols Ranch. Recall that Nichols Ranch has been a problematic asset since acquired from Uranerz Energy Corp. in 2015. As evidenced by the table above, Nichols Ranch ISR production has largely underperformed its domestic ISR peers in terms of average annual production and total cumulative production before the respective project shutdowns.