SNC-Lavalin: Renewed Interest as the Nuclear Division is Poised to Outperform ?

- HoldCo Markets

- Feb 27, 2023

- 3 min read

DISCLAIMER: Any written content contained herein should be viewed strictly as analysis, observation & opinion and not in any way as investment advice. No compensation was received for this report. Visitors to this site are encouraged to conduct their own due diligence.

Following a decade+ of SNC-Lavalin Group (SNC) non-performance, the scandal plagued 2010s are (thankfully) long past as is testament to an overhauled management team and a refined corporate focus. Now led by a solid contract book and favorable macro related tail winds, the time may finally be right to re-examine the SNC investment thesis. Though the company fortunes will remain largely tied to the engineering and infrastructure services (contributing ~70% of FY/2021 revenues) we feel that the nuclear unit in particular will start gaining an increasing share of revenues in the years ahead. With the stock up +14.0% YTD, we take a specific look at SNC’s nuclear unit and gauge what offerings it can provide in light of the positive sector fundamentals. Performance since 2021 is illustrated below:

Without diving into current the nuclear fundamentals, suffice it so say that following the recent passage of the Inflation Reduction Act (IRA) we’ve seen countless nuclear power plants in the US announce an extension of operating lives with some outright reversals on previously scheduled plant retirements. In addition to the announced plant life extensions, nuclear power plants have also been announcing investments to not just maintain, but to actually increase nuclear generating capacity as well. The most recent such announcement was from Constellation Energy (CEG) stating on February 21 that it would be investing $800M to increase the power generating output in tow if its Illinois based nuclear generating stations. In Europe (where SNC also has a large footprint), the emerging themes of energy security and independence have contributed to launch a nuclear renaissance in countries seeking to wean off of Russian supplied natural gas and even from Russian supplied nuclear hardware and services (Rosatom is getting shut-out from central Europe). Lastly, given technological advances, the emergence the Small Modular Reactor (SMR) is becoming increasingly cost effective and applicable in more ways than one. As such, demand and MOUs are being signed at increasingly higher rates. Though still in the early innings with regards to SMR construction and deployment, given a flurry of recent financings, the Nuclear Energy Institute (NEI) has forecasted 300+ SMR being deployed in the U.S. alone by 2050. Ultimately, all of these macro tailwinds (along with increased emphasis ESG and targeted net zero carbon goals) are relevant to SNC because its Nuclear division offers end-to-end solutions covering the entire nuclear plant life cycle:

1) New Builds – Exclusive licensee and steward of CANDU reactor technology, GE Hitachi SMR (North- America), Rolls-Royce SMR (Europe)

2) Operations Support – Design, engineering, support & service

3) Waste Management/Decommissioning - Support & service

For example, SNC has partnered with GE-Hitachi, OPG and Aecon (ARE) to begin work on North America's first grid-scale SMR at the Darlington Nuclear Station located in Ontario. Construction of the BWRX-300 SMR is expected to be completed in 2028.

Additionally, in terms of current infrastructure, SNC is in the midst of prolonging the life of the Darlington nuclear generating site (4 CANDU reactors, 3.5GW nameplate capacity), which provides ~20% of Ontario’s electricity needs. Largely consisting of station retube and feeder replacement, the refurbishments are expected to continue until 2026 and will ultimately ensure 30 more years of reliable low-carbon electricity. For context, recall that the global nuclear fleet stands at ~450 reactors today, of which over 200 are between 30-40 years old and approximately 100 are 40+ years old.

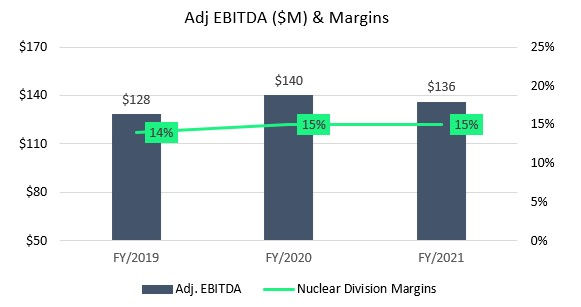

Positive momentum into the nuclear division can be impactful over the longer term seeing as historically, margins from that division have been ~400bps higher than the general Engineering Services division.

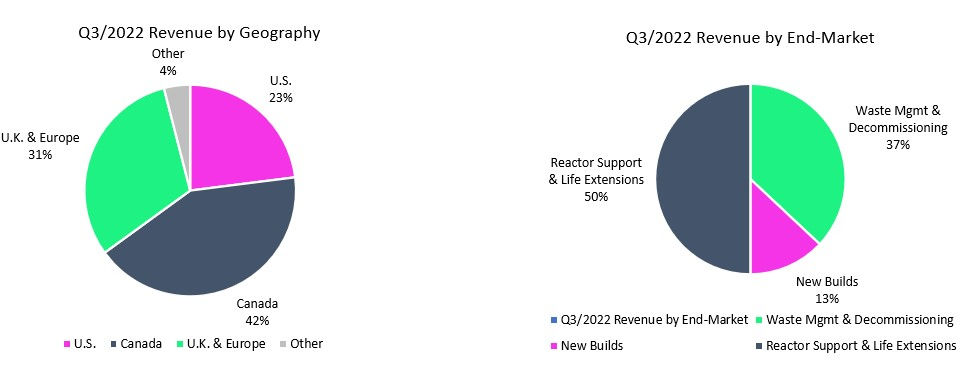

Outside of North America, given a strategic partnership with Rolls-Royce (RR), recent milestones in SNC corporate history include significant partnerships and/or contracts to decarbonize buildings and build zero emission power stations in both the U.K. and Abu Dhabi. That said, nuclear related revenues by geography and end-market were the following in Q3/2022:

For SMRs alone, SNC currently has agreements in place with utilities and companies in the U.S., Poland, Estonia, Sweden, the UK and the Czech Republic to explore deployment of the technology. Given what we believe will be meaningful LT contributions from the Nuclear division, we think the company is worth a closer look given the current valuations (22.0x 2023e aEPS, 17.6x 2024 aEPS and 7.3x 2023e EV/EBITDA, 6.5x 2024e EV/EBITDA). The growth profile will continue to be anchored by the record ~$12.0B backlog from Services while the above average margins from the higher growth (as we expect) Nuclear division will provide the LT upside kicker.