Raising Our LT U Price Target to $120/lb: Revisitng our Coverage Universe

- HoldCo Markets

- Jan 26, 2024

- 6 min read

Updated: Feb 13, 2024

DISCLAIMER: Any written content contained herein should be viewed strictly as analysis & opinion and not in any way as investment advice. No compensation was received for this report. Visitors to this site are encouraged to conduct their own due diligence.

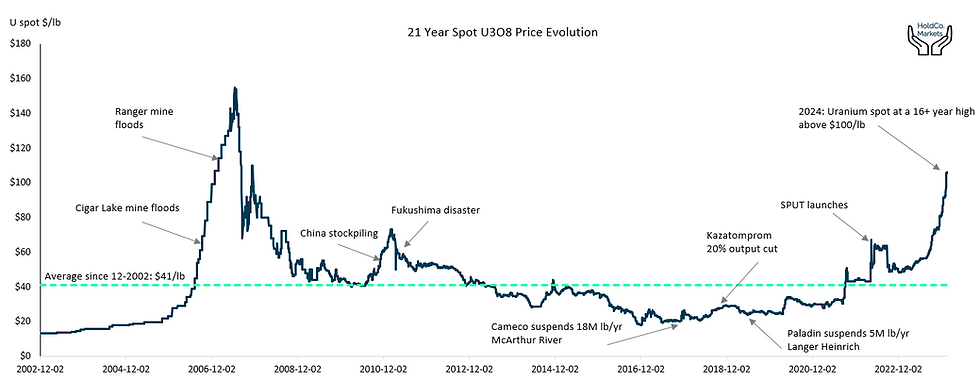

On back of monumental, sector defining milestones to end the year 2023, the spot uranium price closed out the year at a fresh 15-year post-Fukushima high $91.25/lb. These 2H/2023 sector defining milestones included a pledge at COP28 from 22 nuclear nations (including the US, the UK, France and Japan) to triple their installed nuclear capacity by 2050. This pledge represents the most ambitious global endeavor to wean off of fossil fuels. This realization (finally) that renewables alone will not be sufficient to decarbonize energy grids has come in light of the ever prevailing these of energy security and energy independence, following Russia’s invasion of Ukraine. Domestically, the “Prohibit Russian Uranium Imports Act” has already been passed in Congress and now only needs ratification be the Senate to be signed into law by President Biden. Regardless of what retaliatory measures the Russians will impose as a response, ultimately US sourcing of Russian uranium material will come to an end, thus creating even more tightening in an already strained market. At the end of 2023, the uranium spot price ended at $91.25/lb.

Not even a full month into 2024, the spot is currently at the latest 16-year high, having reached $105.5/lb on back of continued supply constraints by the largest producers Cameco (CCJ) and Kazatomprom (KAP). The latest market jolt was announced two weeks ago as Kazatomprom lowered forward production guidance citing the inability to source the sufficient levels of sulfuric acid needed for the ISR production methodology. With a market structurally under-supplied and demand once again growing, we see plenty of runway for continued increases in the near term spot uranium price. In the meantime, China remains on course to add approximately 10 nuclear reactors every year for the next 15 years. This alone solidifies their place as the single largest uranium demand driver for the foreseeable future as they seek a net-zero target for CO2 emissions by 2060. After over a decade of anemic contracting, utilities have materially re-entered the market and have accordingly bumped the LT contracting volumes to an estimated ~150M lbs over the course of FY/2023, representing an 11-year high.

Given all these structural movements, we are increasing our LT uranium price to $120/lb (from $80/lb as increased in October 2023). Given our 50% LT price hike, the average NAV uplift amounted to 62%, highlighted by Fission Uranium (FCU) registering the largest uplift at 89.7% and NexGen Energy (NXE) registering the lowest uplift at 56.6%. Of note is that our current valuation methodology for IsoEnergy (ISO) is a simple in-situ $/lb per specific project while Laramide Resources (LAM) was initiated on earlier this month at a LT uranium price of $110/lb. Our NAV8% valuation methodology remains however the specific company NAV multiples have been reduced by ~10%.

Ur-Energy (URG): Work has been on-going since the December 2022 re-start decision for operations at the Lost Creek ISR site. As per Q3/2023 update announced in late October, 190,000 lbs of U3O8 were sold at an average price of $62.56/lb in the nine month period of 2023 (90,000 lbs delivered in Q3 alone). A total of 280,000 lbs is expected to be sold over the course of FY/2023. On the operational front, Header Houses 2-6 and 2-7 are expected to have been brought online. Recall that Header House 2-5 was previously brought online in Q3/2023. That said, 30,491 lbs were captured in Q3/2023 while 15,759 lbs were drummed. Ending Q3/2023 inventory amounted to 169,945 lbs while cash on hand was $54.6M. Contracting for FY/2024 currently stands at 570,000 lbs. Our most recent company note can be found here:

Peninsula Energy (PENMF): The company was active on the financing front in Q4/2023 as a A$60M capital raise (including a A$10M Securities Purchase Plan) was announced and subsequently voted upon on January 10, 2024. The closing date of the offer was on January 24, 2024. Given over $10M in treasury, combined with the financing, Peninsula will have ample financial resources to complete plant construction and wellfield development and achieve initial ISR production towards the end of 2024. Recall that as announced on August 31, the updated plans for the fully in-housed production from Lance included a revised production profile which now feature higher yearly production (averaging nearly ~1.50M lbs per year) condensed over a shorter, 10-year LOM (previously a lower production spread over a 14-year LOM). Our most recent note can be found here:

enCore Energy (EU): enCore announced in late November 2023 that production was re-started at the Rosita, South-Texas Central Processing Plant (800,000 lb annual capacity). The wellfield production patterns have been operating since with oxygenated water circulating through the satellite ion exchange facility and being injected back into the uranium ore body. More importantly, as announced in January, the resumption of ISR uranium production from Alta Mesa Central Processing plant (1.5M lb annual capacity) is still expected for early 2024. Work remaining includes final inspection of the ion exchange columns, testing the precipitation tanks, completing tie-in of the scrubber system, and installation and testing of the process circuit instrumentation. Recall as well that as announced in December, a 30% stake in Alta Mesa was sold for $70M to ASX-listed Boss Energy Ltd (BOSS). The transaction is expected to close some time in February 2024. Our most recent note can be found here:

Laramide Resources (LAM): Laramide announced in mid-January the details of a much anticipated NI31-101 compliant PEA for the Churchrock ISR project, located in New Mexico. Using a base case LT uranium price of $75/lb and assuming recoveries of 68% from the production area (steady state 3,000 gpm producing a LOM average of 1.0M lbs per year over 31 years), an after-tax NPV8% of $239M along with an IRR of 56% was estimated. Though the possibility to accelerate production to well over 1.0M lbs annually remains, the PEA metrics rank Churchrock as a competitive ISR project in relation to other US focused ISR peers. Our most recent note can be found here:

IsoEnergy (ISO): In December the merger with Consolidated Uranium officially closed. Now with conventional uranium production optionality in the US (Tony M, Daneros and Rim) along with optionality in both Australia and Argentina, the re-vamped IsoEnergy has become drastically diversified from its previously stand-alone Athabasca Basin exposure. The Hurricane deposit, hosting the world’s highest grade Indicated mineral resource remains the priority. Numerous drill targets have already been identified for 2024 drilling. Post-merger, an upsized $20M bought deal private placement was announced with a closing date expected around February 9, 2024. Our most recent company note can be found here:

Denison Mines (DNN): The big news from Denison Mines earlier this week was that in conjunction with 77.5% JV partner, Orano Canada, approval was received to re-start the McClean Lake uranium mining operations. Mining is expected to commence at the McClean North deposit is planned for 2025 with 800,000 lbs of production (100%) targeted for that year. Moreover, an additional 3.0M lbs (100%) have been identified for potential additional production. From the Caribou and McClean north deposits during the years 2026-2030. As for Phoenix/Gryphon, we forecast initial ISR production from Phoenix in 2027.

NexGen Energy (NXE): Work has continued at a consistent pace at the Rook I project located in the Athabasca Basin. A notable milestone was achieved this past November given the provincial approval of the Environmental Assessment (EA) for the Rook I Project. This approval marked a significant milestone in the de-risking and advancement of the project which we continue seeing as being able to produce an average of ~20M lbs annually, over an 11-year LOM. With Provincial EA approval now in place, NexGen has submitted all responses to the Federal technical review of the Rook I Project Environmental Impact Statement. We also note that in late September, the company announced that it had closed on a strategic $110M convertible debenture financing (convertible at $6.76, maturity on September 22, 2028).

Fission Uranium (FCU): Fission Uranium announced in mid January that preparations are underway to commence the 6,000m winter regional exploration program. Numerous targets have already been identified along the Patterson Lake corridor. Drilling will test for deeper uranium mineralization along the east-west electromagnetic (EM) conductor where a sharp conductivity thickness gradient occurs coincident with an interpreted north-northeast cross cutting fault. Following the closing of an upsized $9.2M bought deal financing (October 2023 - 7.73M flow-through shares at a price of C$1.19 per flow-through), a 13-hole regional exploration program was announced. Recall that in April 2023, the company submitted an application to construct a uranium mine and mill facility at the PLS site. A previously released Feasibility Study (FS) envisioned a 10 year LOM operation producing an average of just over ~9.0M lbs of uranium per year.

We will follow up this report with Part 2 (shortly) focusing on the individual project sensitivities to changes in the underlying LT uranium price.