The Month in U Inventory: Uranium Spot Continues Higher; Now Tops $90/lb.

- HoldCo Markets

- Jan 2, 2024

- 3 min read

Updated: Feb 13, 2024

DISCLAIMER: Any written content contained herein should be viewed strictly as analysis & opinion and not in any way as investment advice. No compensation was received for this report. Visitors to this site are encouraged to conduct their own due diligence.

The uranium spot price continued its upward march on the month as it advanced by +13% to reach a quote of $91.50/lb to end the month of December. This represents the latest sixteen year, post-Fukushima high. The month of December remained active on the inventory front with SPUT (U.UN, U.U) adding +256,000 lbs and thus bringing its total number of purchased lbs to nearly +3.9M lbs over the FY/2023 period. Since inception, total purchases have amounted to nearly ~45M lbs. We note that the Trust filed a new $1.50B preliminary base shelf prospectus on December 29. It was also announced that for the current time, the Trust will not be implementing a redemption feature due to the ever-changing market dynamics. Management stated that the Trust has traded closely to its NAV since the run-up in spot price this September. As such, this has negated any potential benefit from the redemption feature. Spot purchases have also been limited to 9.0M lbs however as noted earlier for context, FY/2023 purchases amounted to just below 3.9M lbs.

Given continued tightness on the supply front (material production shortcomings from Kazakhstan and Niger along with top producer Cameco signaling recently stating that it may need to buy additional uranium in order to meet delivery obligations) coupled with the well documented, robust demand environment, we have rolled our LT uranium price objective higher, going from $80/lb to $90/lb currently.

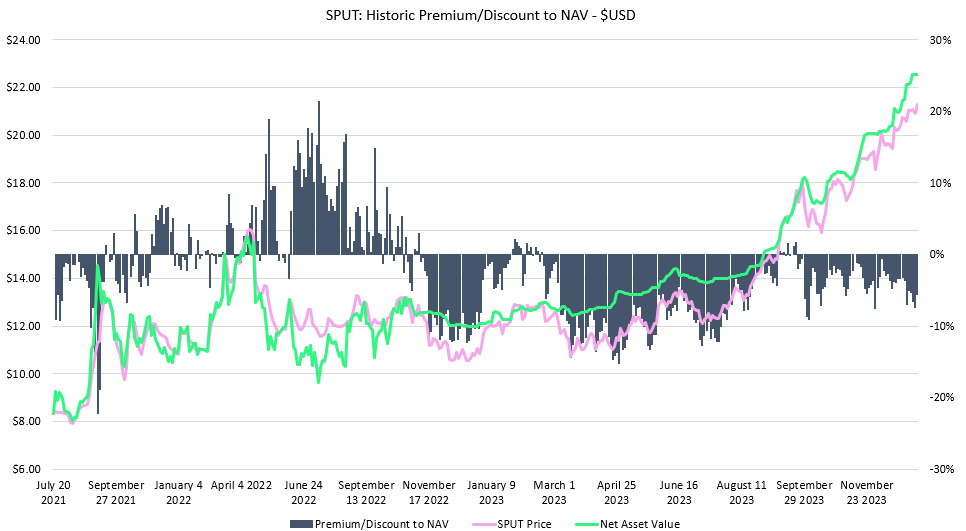

Sprott Physical Uranium Trust (U.UN-T, U.U-T): 2-Yr Performance:

Valuation: Given current pricing, SPUT's discount to NAV increased from last month's -4.8% to the current -5.5% with the Trust now trading at a 0.94x P/NAVPU relative to its intrinsic value of $29.91. Note that following a slight valuation premium from earlier in September, the valuation discount has since largely been maintained as of October. The discount however currently remains well off the largest YTD -15% spread from April 2023. Given our revised LT $90/lb price objective for the spot and constant CAD/USD exchange rate, our 1.05x NAVPU valuation of $33.00 (rounded) has been established. For context, the current -5.5% discount to NAVPU is relative to +26% premium in September 2021 and -18% discount from July 2022. We note that as per YTD 2023 performance, shares of the Trust (U.UN) have advanced by +87%. The corresponding sensitivities to FX and the spot price are below:

We continue to stress that a narrower discount relative to Yellow Cake's P/NAV (-5.5% compared to -15.4%) continues to be warranted, however the spread may be overdone. In addition to higher liquidity and inventory, SPUT has much less direct exposure to uranium sourced from Kazakhstan, via option agreements with Kazatomprom (KAP). We would venture to suggest that the current relative discount spread of nearly 10% is likely stretched.

Yellow Cake PLC (YCA-L): 2-Yr Performance:

Valuation: Given the most recent spot U3O8 quote at $91.50/lb (or £72.29/lb), YCA is trading at 0.85x P/NAVPU, or at a -15.4% discount given the current 1.0x NAVPU intrinsic value of £731.05. We note that YCA's discount widened from November's -12.4%. Though Yellow Cake normally trades at a larger discount to intrinsic value relative to SPUT (justifiably reflecting the smaller size, liquidity and larger perceived delivery risk associated with Kazakh sourced uranium), we feel that the current relative discount of nearly ~10% remains overdone. Given our revised LT $90/lb price objective for the spot and a constant GBP/USD foreign exchange rate, our 0.95x NAVPU valuation of £780 (rounded) is established. We note that as per YTD 2023 performance, shares of the Yellow Cake (YCA.L) have advanced by +69%. The corresponding sensitivities to FX and the spot price are below:

Recall that under the Kazatomprom Framework Agreement (KFA), Yellow Cake maintains the option to purchase up to $100M of U3O8 each year for a period of nine years, starting from the company's IPO in 2018. That said, it is our view that geo-politics will continue to weigh on Kazakh sourced uranium, and in general on all companies with exposure to Kazakhstan, (despite transport routes which completely bypass Russia). Recall that in September, Kazatomprom stated plans to increase production in 2025 to 100% of subsoil agreements, thus producing a total of ~79.3M-81.9M lbs U3O8. This comes amid the current environment in which the procurement of the needed production materials is strained. The ambitious production targets represent an increase of +28M lbs compared to FY/2023 planned production between 55.3M-55.9M lbs U3O8. This production is already committed under LT contracts.