Copper Fox Metals: Schaft Creek Update; Expecting a PFS Start in 2026

- HoldCo Markets

- Oct 16, 2025

- 5 min read

DISCLAIMER: Any written content contained herein should be viewed strictly as analysis & opinion and not in any way as investment advice. Visitors to this site are encouraged to conduct their own due diligence. As a Research Spotlight product, HoldCo Markets has received financial compensation for the written content and analysis below. Please read the full disclaimer here: holdcomarkets.com/disclaimer

This morning Copper Fox Metals (CUU) issued an update on current activities taking place at the Schaft Creek copper-gold-molybdenum-silver project (75% TECK, 25% CUU), located in northwest British Columbia. The various field programs conducted this year (highlighted by drilling, various geophysical surveys and environmental activities) continue to set the stage for an anticipated transition to the prefeasibility study (PFS) stage, anticipated to commence in early 2026.

Copper Fox management has consistently demonstrated a methodic approach towards de-risking and developing its portfolio of assets. With Schaft Creek, Teck Resources is continuing this methodology with the end result allowing for a better understanding of the full size and scope of the large polymetallic deposit. We are well on the way to see the start of a PFS in early 2026. This study is well due given that gold and copper prices (among others) have advanced by +187% and +55% respectively from the LT estimates used in the 2021 PEA. Given the most recent close (October 15), shares of Copper Fox currently trade at a 0.16x P/NAV valuation, or at C$0.02 per booked CuEq lbs. We maintain our C$0.60 per share price objective.

THE CONTINUED DE-RISKING OF SCHAFT CREEK

Recall that the Schaft Creek JV is managed by Teck Resources (TECK) as operator and 75% owner. Copper Fox maintains a 25% interest. Teck Resources committed a total of C$15.8M towards the development of Schaft Creek in 2025. In terms of work conducted during the year, a total of five diamond drillholes totaling 1,797m were completed in an area south of the Liard Zone. Four of the drill holes intersected variable intervals of discontinuous copper mineralization. Four of the drillholes intersected variable intervals of discontinuous chalcopyrite, +/- bornite mineralization. The core samples have been submitted for analysis, results are pending. Recall that in 2024, a total of six geotechnical drill holes totaling 2,472m were drilled by Teck Resources. In 2023, Teck Resource drilled a total of ten drill holes totaling 3,288m. Since 2013, Teck has spent a cumulative C$113.8M on the Schaft Creek Project. The 2025 drill locations are below:

Though the results from the 2025 drill program are still pending, for context, recall that a total of six geotechnical drill holes totaling 2,472m were drilled in 2024 by Teck. Three of the six holes intersected significant intervals of porphyry style mineralization and extended the mineralization in the Paramount zone approximately 250 m to the north. Highlights included:

DDH SCK-24-471: intersected a core interval of 134.60m (21.60 to 156.20m) that averaged 0.338% copper, 0.037% molybdenum, 0.058 g/t gold and 0.78 g/t silver that included a 63.80m core interval (59.20 to 123.00m) that averaged 0.437% copper, 0.066% molybdenum, 0.050 g/t gold and 1.11 g/t silver.

DDH SCK-24-472: intersected a core interval of 208.64m (406.10 to 614.74m) that averaged 0.253% copper, 0.014% molybdenum, 0.115 g/t gold and 0.88 g/t silver.

DDH SCK-24-476: intersected a core interval of 202.60m (189.70 to 392.30m) that averaged 0.324% copper, 0.023% molybdenum, 0.044 g/t gold and 1.68 g/t silver that included a 14.40m core interval (196.80 to 211.20m) that averaged 0.634% copper, 0.104% molybdenum, 0.092 g/t gold and 3.48 g/t silver.

In terms of additional fieldwork undertaken in 2025, a plethora of additional surveys and studies have been conducted on site. The work included geophysical surveys, SERA studies and geometallurgical test work. Moreover, hydrology, hydrogeology, glacier and meteorology baseline studies were also conducted. Specifically, electrical resistivity tomography (13,310m) and seismic refraction (6,825m) surveys were completed to map the thickness of overburden in the proposed locations for the two potential rock storage facilities. Modelling of both data sets is expected to be completed by the end of the year. Additionally, the preliminary results for the sulphide flotation testwork indicate that there is more variability of copper recovery in certain spatial areas of the deposit relative to others. Ongoing work is being conducted to quantify the volume represented by these zones of greater variability, with future testwork being planned in these more variable zones. The preliminary interpretation of the greater variability is presence of minor amounts of copper oxides, and low liberation of copper sulphides in these areas.

SCHAFT CREEK – LOCATED IN BRITISH COLUMBIA’S GOLDEN TRIANGLE

Galore Creek, KSM and Brucejack are major mines and/or projects all located in close proximity to Schaft Creek. Newmont’s Brucejack operation is one of the highest grade gold mines in the world and a core property for Newmont. In operation since 2017, Brucejack is expected to produce 255,000 gold ounces in FY/2025. As per gold/copper projects, Seabridge Gold’s KSM Project is considered to be one of the world’s largest undeveloped gold and copper projects given it’s estimated 47.3M ounces of gold and 7.3B lbs of copper in the Proven & Probable (2022 PFS). Lastly, TECK/Newmont’s nearby Galore Creek Project has a resource estimate of 12.2B lbs of copper and 9.4M ounces of gold. Schaft Creek is located just 47 km northeast of the Galore Creek property.

SCHAFT CREEK 2021 PRELIMINARY ECONOMIC ASSESSMENT

Results the 2021 Preliminary Economic Assessment indicated a 21-year LOM mining operation capable of producing a total of 5.0B lbs of copper, 3.7M ounces of gold, 226M lbs of molybdenum and 16.4M ounces of silver. Project economics were estimated using LT base case pricing of $3.25 per lb Cu, $1,500 per ounce Au and $10 per lb Mo. Factoring in a C1 cash cost of $1.00 per lb and pre-production capital of $2.65B (including indirect costs and a 28% contingency), an after-tax NPV8% of $842M, along with an after-tax IRR of 12.9% was calculated. Though the 2021 PEA provided a degree of sensitivity analysis to movements in the underlying LT commodity prices, the upcoming PFS will reflect commodity prices which have all increased significantly since 2021.

CONCLUSION & VALUATION

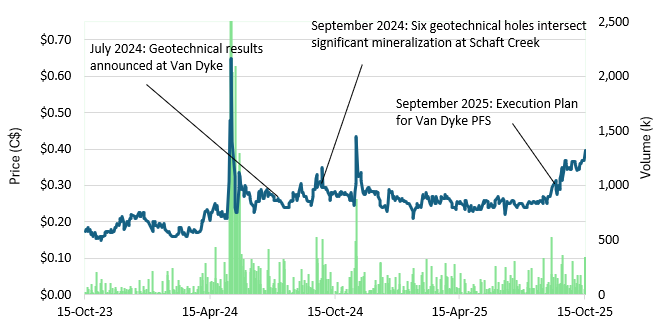

We’re glad to see that work is advancing simultaneously on all portfolio projects as management has previously emphasized a systematic approach for each, in an effort to advance and de-risk, while also in an effort to allocate capital efficiently. With Schaft Creek, Teck Resources is continuing this methodology with the end result allowing for a better understanding of the full size and scope of the large polymetallic deposit. We are well on the way to see the start of a PFS in early 2026. The PFS is well due given that gold and copper prices (among others) have advanced by +187% and +55% respectively from the LT estimates used in the 2021 PEA. Given the most recent close (October 15), shares of Copper Fox currently trade at a 0.16x P/NAV valuation, or at C$0.02 per booked CuEq lbs. We maintain our C$0.60 per share price objective.

Shares of Copper Fox currently trade at attractive levels versus peers: at a 0.16x P/NAV valuation and at an EV of C$0.02 per booked CuEq lbs. Our price objective equates to upside of +54% from the most recent close (October 15). For more specific information on all the company assets, refer to our June 18, 2025 initiation of coverage piece.