Myriad Uranium: Copper Mountain Ownership Increases to 75%

- HoldCo Markets

- 5 days ago

- 5 min read

DISCLAIMER: Any written content contained herein should be viewed strictly as analysis & opinion and not in any way as investment advice. Visitors to this site are encouraged to conduct their own due diligence. As a Research Spotlight product, HoldCo Markets has received financial compensation for the written content and analysis below. Please read the full disclaimer here: holdcomarkets.com/disclaimer

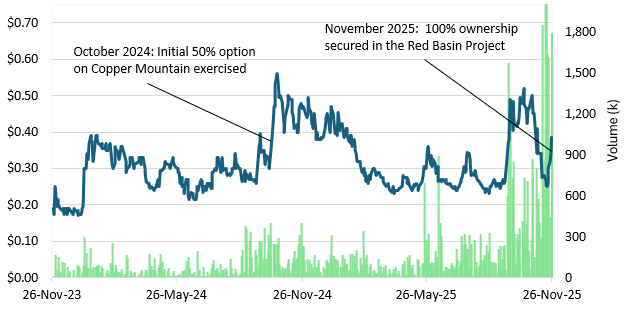

On December 8 2025, Myriad Uranium (M) officially announced that given the exploration spend to date, it’s ownership stake in the Copper Mountain Uranium Project has increased from 50% to 75%. Additionally, Myriad announced late last week that a large scale helicopter-borne radiometric and magnetic survey was completed across the entire project. In accordance to the property option agreement signed with Rush Rare Metals Corp. (RSH) dated on October 18, 2023, given the C$5.5M+ of eligible expenditures spent on the property, Myriad’s stake now stands at 75%. Armed with plenty of historic data and following a recent financing (~C$9.5M currently in treasury), Myriad is in good shape to begin its 2026 drilling campaign. That said, we maintain our C$0.62 per share price objective which equates to upside of +77% from the most recent close.

RADIOMETRIC & MAGNETIC SURVEYS COMPLETED

The recently announced radiometric and magnetic surveys were conducted by helicopter and covered an area of ~192 km2. Specifically, a total of 2,114 line-kilometres was completed at 100m line spacing and with 1,000m tie lines. Note that preliminary uncorrected magnetic and radiometric images have already been received however final processed data and outputs are expected in January.

APPROVAL RECEIVED FOR UP TO 222 BOREHOLES AT COPPER MOUNTAIN

Myriad Uranium announced on October 9 that the Bureau of Land Management (BLM) approved the Plan of Operations for the company's Copper Mountain Uranium Project. The Plan of Operations was submitted as a technical amendment to the existing Drilling Notification put in place for the 2024 drilling season. The amendment allows for an expanded drilling campaign now comprising up to 222 boreholes spread across the entirety of the project. Under the current Drilling Notification with the State of Wyoming, Myriad is bonded for 70 of those holes (of which, 50 holes are carried over from the Canning area. The Drilling Notification can be updated to bond the remaining holes in subsequent phases. Details for the drilling program will be disclosed later this quarter.

Located in central Wyoming, the Copper Mountain Project is strategically located near the needed infrastructure and in close proximity to the Sweetwater uranium mill. The Project currently hosts numerous deposits (historic) and target areas. Spread across the entirety of the Copper Mountain Uranium Project, the approved Plan of Operation includes highly prospective areas such as Mint, Arrowhead, Lucky Cliff and Gem, in addition to the main Canning target area. Of the 70 total holes currently bonded, 50 are specifically carried over from the Canning area. The Plan will be amended and additional drilling bonded on an ongoing basis as the Company’s exploration strategy for Copper Mountain progresses. Myriad's strategy is to continue to confirm the presence of historically identified mineralization while also demonstrating the broader potential of Copper Mountain to host many more large deposits.

As identified and described in historic documents prepared by Union Pacific (RMEC), the target areas of particular interest include:

Arrowhead: The Arrowhead Mine area included the historic Arrowhead-Little Moe Mine which, according to public records, produced in excess of 500,000 lbs of uranium at a recorded grade of 1,500 ppm U3O8 from shallow underground workings in Tertiary sediments during the 1950s and 1960s. Union Pacific estimated that significant uranium remains in the Tertiary sediments at Arrowhead and possibly in the underlying granites.

Lucky Cliff: Union Pacific drilled 22 holes at Lucky Cliff and intersected relatively shallow mineralization hosted in faulted granite in several very thick, shallow mineralization of up to 108m (355 feet) thick starting at 59 feet.

Gem: The Gem deposit was estimated by Union Pacific to contain Indicated and Inferred resources of 3.07Mt containing 1.44M lbs eU3O8 at an average grade of 234 ppm eU3O8 (Union Pacific/RMEC, 1977). Mineralisation at the Gem deposit occurs within granitic rocks in the top 60 metres (200 feet) from the surface. Several thousand tons of uraniferous granite was reportedly mined from the Gem deposit in the 1950’s by a prospector and stockpiled in the vicinity of the mine. None of this material was shipped for milling.

Mint (Fuller West): At least 50 holes were drilled by Union Pacific at the Mint deposit. The deposit was reported (Fluor, 1980) to contain Indicated and Inferred resources of 3.68Mt containing 1.41 Mlbs of eU3O8 at an average grade of 141 ppm eU3O8. Mineralization is hosted in granitic basement and overlying sediment.

RECENT DRILLING – MYRIAD URANIUM (2024)

When Myriad Uranium announced the conclusion of its maiden Copper Mountain drilling campaign in November, 2024, this marked the first drilling campaign on site since 1979. In total, the company drilled 34 boreholes in which initial probe results indicated over 30 intervals greater than 3.0 ft and over 1,000 ppm eU3O8. Moreover, eleven holes were able to validate the historical drilling while also delivering higher than expected grades. Just as importantly, the maiden drill program confirmed that mineralization also occurs below the maximum depth of 500-600 ft as from the historic drilling program. As per targeted areas, Myriad’s drilling program prioritized Canning due to Union Pacific’s 1979 mine plan which identified it as the largest mineralized area and the central pit of an initial six pit mining plan. Once all assay results were received from the 34 boreholes (June 2025), it was concluded that the gamma probe results underestimated many of the grades. Of the total boreholes, the assay results indicated that the U3O8 grades were on average:

60% higher at a 1,000 ppm cut-off.

50% higher at a 500 ppm cut-off.

20% higher at a 200 ppm cut-off.

Many intervals with initially low or near-zero probe readings have been confirmed as mineralized by chemical assays. In addition to the confirmation program, one of the aims of the drilling program was to test for deeper mineralization, below the levels that RMEC reached during its drilling program in the late 1970s (around 500-600 feet on average). Of note, Myriad’s deepest drill hole (CAN0034 – drilled to a depth of 1,556 ft) returned 832.5 ppm U3O8. This represents a 242% increase over its equivalent probe grade.

More recently, Myriad announced on October 27 that updated chemical assays received from samples obtained while drilling last fall have provided material positive implications for Copper Mountain’s overall resource potential. Specifically, the updated assay results from the Canning deposit have indicated both enhanced uranium grades and extended mineralised intervals. The updated assays have positive implications for the Project’s overall resource potential. The assays have extended 12 already known intervals while also revealing 70 new intervals. Ultimately, the additional samples have illustrated that there is significantly more uranium reported than was previously accounted for.

VALUATION & CONCLUSION

Using the historic resource as a weighted benchmark, we continue to apply our $3.25 per lb in-situ valuation along with a target NAV multiple of 0.60x. Note that we were already carrying Copper Mountain at 75% ownership. Factoring in the other assets along with corporate adjustments (a recent C$8.6M financing), we maintain our in-situ based price objective (12 months) of C$0.62 per share. This equates to potential upside of +77% from the most recent close on December 5. Recall that along with the recent 100% ownership secured at the Red Basin Uranium Project (announced on November 26), management is clearly signaling confidence in both assets. For additional details, see our initiation of coverage report dated August 8, 2025, or any subsequent note. Myriad shares currently trade at a 0.35x NAV multiple.

NEAR-TERM TIMELINE & POTENTIAL CATALYSTS

Consolidation of the Copper Mountain project. Negotiations on-going with Rush Rare Metals.

Details for any upcoming drilling campaign.

An eventual NI43-101 resource estimate for Copper Basin.

An eventual TSXV listing and/or a US listing.