Myriad Uranium: Plan of Operation Approved for Copper Mountain Drilling

- HoldCo Markets

- Oct 10

- 7 min read

Updated: Oct 16

DISCLAIMER: Any written content contained herein should be viewed strictly as analysis & opinion and not in any way as investment advice. Visitors to this site are encouraged to conduct their own due diligence. As a Research Spotlight product, HoldCo Markets has received financial compensation for the written content and analysis below. Please read the full disclaimer here: holdcomarkets.com/disclaimer

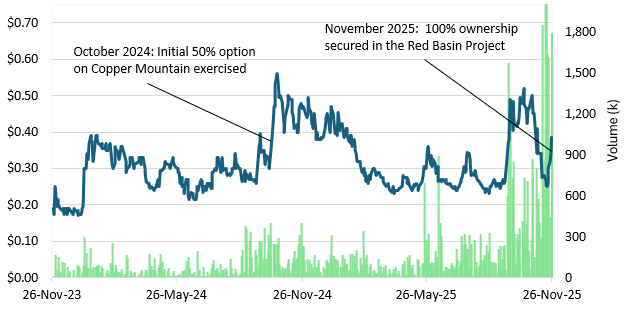

Myriad Uranium (M) announced on October 9 that the Bureau of Land Management (BLM) approved the Plan of Operations for the company's Copper Mountain Uranium Project. The Plan of Operations was submitted as a technical amendment to the existing Drilling Notification put in place for the 2024 drilling season. The amendment allows for an expanded drilling campaign now comprising up to 222 boreholes spread across the entirety of the project. Under the current Drilling Notification with the State of Wyoming, Myriad is bonded for 70 of those holes. The Drilling Notification can be updated to bond the remaining holes in subsequent phases. Details for the drilling program will be disclosed later this quarter. We maintain our 12-month price objective of C$0.62 per share equates to upside of +39% from the most recent close. Shares of Myriad Uranium currently trade at a 0.38x NAV multiple.

Given the BLM approval for Myriad's updated Plan of Operations for Copper Mountain, note that out of the expanded 222 boreholes allowable over the project, the company is currently bonded for 70 of those holes. Of the 70, a total of 50 of which were carried over from Canning during the previous drilling season last year. Additional bonding will occur on an ongoing basis, as exploration progresses on the project. The areas currently covered by the Plan include Mint, Arrowhead, Lucky Cliff and Gem, as well as additional drilling at Canning. Myriad's strategy is to continue to confirm the presence of historically identified mineralization while also demonstrating the broader potential of Copper Mountain to host many more large deposits.

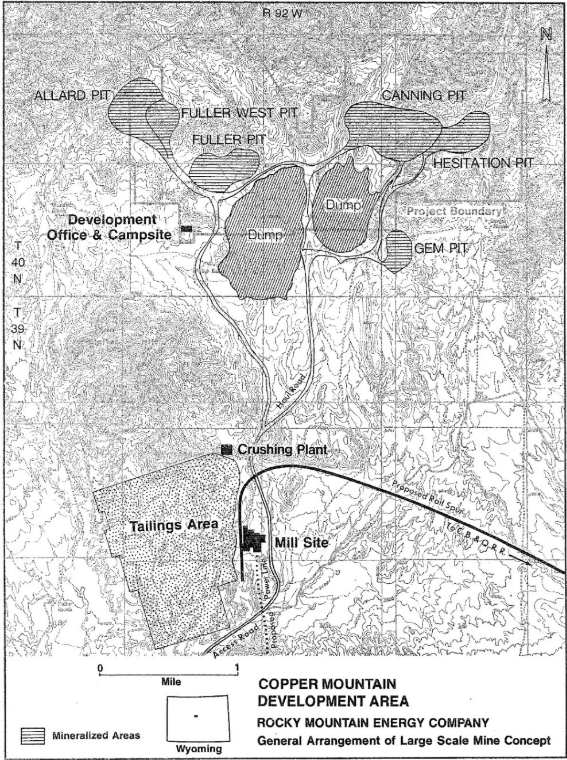

Located in central Wyoming, the Copper Mountain Project is strategically located near the needed infrastructure and in close proximity to the Sweetwater uranium mill. The Project currently hosts numerous deposits (historic) and target areas. Spread across the entirety of the Copper Mountain Uranium Project, the approved Plan of Operation includes highly prospective areas such as Mint, Arrowhead, Lucky Cliff and Gem, in addition to the main Canning target area. Of the 70 total holes currently bonded, 50 are specifically carried over from the Canning area. The Plan will be amended and additional drilling bonded on an ongoing basis as the Company’s exploration strategy for Copper Mountain progresses. Myriad's strategy is to continue to confirm the presence of historically identified mineralization while also demonstrating the broader potential of Copper Mountain to host many more large deposits.

As identified and described in historic documents prepared by Union Pacific (RMEC), the target areas of particular interest include:

Arrowhead: The Arrowhead Mine area included the historic Arrowhead-Little Moe Mine which, according to public records, produced in excess of 500,000 lbs of uranium at a recorded grade of 1,500 ppm U3O8 from shallow underground workings in Tertiary sediments during the 1950s and 1960s. Union Pacific estimated that significant uranium remains in the Tertiary sediments at Arrowhead and possibly in the underlying granites.

Lucky Cliff: Union Pacific drilled 22 holes at Lucky Cliff and intersected relatively shallow mineralization hosted in faulted granite in several very thick, shallow mineralization of up to 108m (355 feet) thick starting at 59 feet.

Gem: The Gem deposit was estimated by Union Pacific to contain Indicated and Inferred resources of 3.07Mt containing 1.44M lbs eU3O8 at an average grade of 234 ppm eU3O8 (Union Pacific/RMEC, 1977). Mineralisation at the Gem deposit occurs within granitic rocks in the top 60 metres (200 feet) from the surface. Several thousand tons of uraniferous granite was reportedly mined from the Gem deposit in the 1950’s by a prospector and stockpiled in the vicinity of the mine. None of this material was shipped for milling.

Mint (Fuller West): At least 50 holes were drilled by Union Pacific at the Mint deposit. The deposit was reported (Fluor, 1980) to contain Indicated and Inferred resources of 3.68Mt containing 1.41 Mlbs of eU3O8 at an average grade of 141 ppm eU3O8. Mineralization is hosted in granitic basement and overlying sediment.

HISTORIC COPPER MOUNTAIN RESOURCE ESTIMATES & FOLLOW-UP REVIEW REPORTS

In 1978, RMEC estimated Copper Mountain’s resource estimate potential to be as high as 63.8M lbs when factoring in “just” 2 of the 5 identified deposits (Canning and Fuller). At a 0.01% eU3O8 grade cut-off, the resource estimate from the Canning pit alone was estimated to be 21.1M lbs U3O8. In 1980, Fluor followed up with a study of its own (commissioned by RMEC) in what was considered to be a much more conservative estimate due to the methodology used - conditional lognormal probability distributions. Using the chosen conditional probability, Fluor applied a delayed fission neutron (DFN) adjustment which reduced the grades. Ultimately, an estimate of 14.6M lbs was calculated for Canning and parts of four other surrounding deposits (Fuller, Mint, Allard and Hesitation).

In 1991, Anaconda Resources Inc. commissioned a Summary Report on Copper Mountain, using both the RMEC (1978) and Fluor (1980) reports as a basis, however incorporating development work to date as well. The Summary Report was conducted by Gregory Liller who confirmed the Copper Mountain deposit to be not only amenable to heap leach, but also as an economically viable project (among other conclusions). In 1997, Anaconda Uranium Corporation commissioned A.C.A Howe International Ltd to prepare a second Summary Report study on the Project. Prepared by Bojan Zabev, preparation for the study included a database not included in the original reports. The Zabev report included a comparison between natural gamma probe and delayed fission neutron (DFN) derived U3O8 grades as generated by RMEC. Incorporating the Canning deposit along with portions of 6 other deposits (Fuller, Mine, Allard, Hesitation, Arrowhead and Gem) the Liller and Zabev reports were summarized as seeing the total resource between a range of 15.7M-30.1M lbs U3O8.

Though historic in nature, the vast array of geological data received from the 900,000+ ft of historic exploration conducted at Copper Mountain ultimately serves to partially de-risk the Project while also serving to provide a basis for benchmarking expectations. The various studies and methodologies applied for resource estimation also serves to study and stress test the deposit assumptions. Data from the Bendix study will further stress test and fine tune the estimates and targets going forward. A historic deposit summary ranging between 15.7M-30.1M lbs U3O8 is an excellent starting point to resume exploration activities. It is worth noting that in 1982, referencing the Bendix study, the US DOE stated that Copper Mountain’s potential may be 200M lbs in the known deposit areas.

RECENT DRILLING – MYRIAD URANIUM (2024)

When Myriad Uranium announced the conclusion of its maiden Copper Mountain drilling campaign in November, 2024, this marked the first drilling campaign on site since 1979. In total, the company drilled 34 boreholes in which initial probe results indicated over 30 intervals greater than 3.0 ft and over 1,000 ppm eU3O8. Moreover, eleven holes were able to validate the historical drilling while also delivering higher than expected grades. Just as importantly, the maiden drill program confirmed that mineralisation also occurs below the maximum depth of 500-600 ft as from the historic drilling program. As per targeted areas, Myriad’s drilling program prioritized Canning due to Union Pacific’s 1979 mine plan which identified it as the largest mineralized area and the central pit of an initial six pit mining plan. Once all assay results were received from the 34 boreholes (June 2025), it was concluded that the gamma probe results underestimated many of the grades. Of the total boreholes, the assay results indicated that the U3O8 grades were on average:

60% higher at a 1,000 ppm cut-off.

50% higher at a 500 ppm cut-off.

20% higher at a 200 ppm cut-off.

Many intervals with initially low or near-zero probe readings have been confirmed as mineralized by chemical assays. In addition to the confirmation program, one of the aims of the drilling program was to test for deeper mineralisation, below the levels that RMEC reached during its drilling program in the late 1970s (around 500-600 feet on average). Of note, Myriad’s deepest drill hole (CAN0034 – drilled to a depth of 1,556 ft) returned 832.5 ppm U3O8. This represents a 242% increase over its equivalent probe grade.

VALUATION

Using the historic resource as a weighted benchmark, we continue to apply our $3.25 per lb in-situ valuation along with a target NAV multiple of 0.60x. Factoring in the other assets along with corporate adjustments (a recently closed private placement), we maintain our in-situ based price objective (12 months) of C$0.62 per share. This equates to potential upside of +39% from the most recent close (October 9). Note that since our initiation of coverage report on August 8 2025, Myriad shares have increased by +59%. Shares of the company currently trade at a 0.38x NAV multiple.

CONCLUSION

What gives Myriad Uranium a big head-start with regards to developing Copper Mountain is the substantial project de-risking already achieved by way of its historic drilling program. The recently acquired Bendix study only adds to further de-risk the Project while also providing additional data to further refine and fine tune the upcoming drilling program. Guided by this treasure trove of data (2,000+ historic drill holes on site), the recent and forthcoming drill program will build upon what has already been ascertained. Seeing as the recent assay results have largely surpassed grades as estimated from gamma probe testing, the potential to confirm the historic resource is apparent, but so is the potential to expand and grow the resource as well. We look forward to the additional assay results and eventual details for the upcoming drilling campaign. Pending positive drilling success and given numerous other near term catalysts, it is our opinion that the risk remains on the upside for a valuation re-rate higher. Refer to our August 8, 2025 initiation of coverage report for added details and analysis.

NEAR-TERM TIMELINE & POTENTIAL CATALYSTS

Copper Mountain assay results from an additional 8-12 drill holes are expected in the near term.

Geophysical surveys for both Copper Mountain and Red Basin.

Additional chemical assays of samples drilled in late 2024 to identify additional uranium which is invisible to the gamma and DFN probes.

Consolidation of the Copper Mountain Project. LOI concluding with Rush Rare Metals.

An eventual NI43-101 resource estimate for Copper Basin.

An eventual TSXV listing and/or a US listing.