IsoEnergy: Expecting Big Progress From the Current Utah Drilling Campaign

- HoldCo Markets

- Sep 26, 2025

- 3 min read

DISCLAIMER: Any written content contained herein should be viewed strictly as analysis & opinion and not in any way as investment advice. No compensation was received for this report. Visitors to this site are encouraged to conduct their own due diligence.

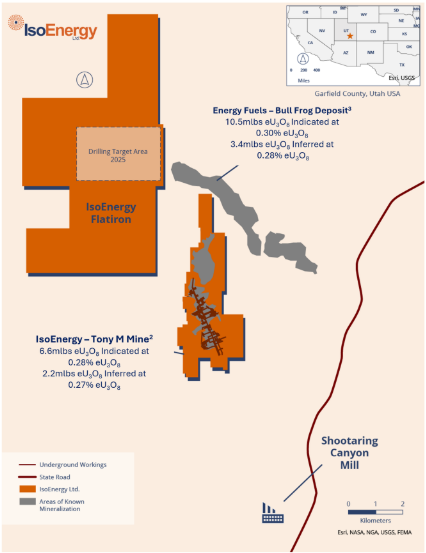

IsoEnergy (ISO) has detailed its 2025 US exploration program which is set to commence shortly. The program will focus on advancing IsoEnergy’s portfolio of uranium projects located in southeast Utah. With 15,000ft of drilling planned for the Flatiron claims (located in the Henry Mountain uranium district), the aim of that particular drilling campaign will be to follow-up on historical, regional exploration as undertaken in the early 1980s. We maintain our C$17.95 per share price objective which equates to upside of 29% from the most recent close (September 25). Shares of IsoEnergy currently trade at 0.78x discount to NAV.

Specifically at the Flatiron project, the initial drill program will involve 10 surface rotary holes with core tails, totaling 15,000ft. The Flatiron project is a large claim package located in Utah’s Henry Mountain uranium district, one of the state’s most historically productive uranium districts. IsoEnergy staked the 370 lode claims that comprise the Flatiron project in 2024. Two Utah state leases were later added to bring the total land position to 8,800 total acres. The Flatiron project is one of the largest contiguous land positions in the Henry Mountain District. To date, approximately 1.4M lbs of U3O8 was produced from that district. The project is located on trend with known deposits (Tony M, Bullfrog) and is strategically situated just 11km northwest of the past producing Tony M uranium mine. The planned drilling campaign will evaluate high potential targets defined from historic exploration conducted by Plateau Resources in the early 1980s.

Plateau Resources, the original developers of these deposits, previously conducted wide-spaced, district-scale drilling to identify uranium mineralization concealed beneath surface cover. These historic holes were drilled on centers of more than one-mile, with two of the highest-priority results located within the current Flatiron claims.

... AND DEVELOPMENT ELSEWHERE IN UTAH

IsoEnergy’s exploration campaign will also focus on the continuing field work being conducted at the Daneros and Sage Plain properties. Like Tony M, both properties are past producers and have been on standby for a strategic restart. Recently conducted fieldwork including mapping the extent of the prospective host units will be used to guide future exploration and will determine the most appropriate geophysical survey techniques to locate the productive units without the need for expensive and pervasive surface drilling.

Recall that significant drilling has been conducted between 2007-2008 at Daneros to confirm the historical resource. The Daneros mine was in operation between 2009 until it was placed on standby in 2012. In terms of the current exploration potential, higher-grade mineralization occurs in paleochannels that are more than 20ft thick. Identifying and targeting these areas may lead to the discovery of further mineralization.

CONCLUSION & VALUATION

Looking specifically at the US portfolio, management rightfully continues to prioritize the projects located within the periphery of the White Mesa Mill (Energy Fuels, UUUU) and having either historic production and/or extensive historic work conducted on site. These characteristics fit the corporate focus of developing assets which would provide for a shorter time frame to actual production (or re-started production). Recall that Tony M, Daneros and Rim are fully permitted. We maintain our 1.0x target NAV multiple which leads to a price objective of C$17.95. This implies 29% upside from the most recent close (September 25). ISO shares currently trade at 0.78x discount to NAV.